How much is statutory sick pay in the UK? (And why you should offer more)

You want to support your employees when they fall ill and are unable to work. You want to be fair to them and make sure they’re not put out because they’re not running at 100%. However, it’s also understandable that you’re concerned about the impact of their absence on your business.

It happens to small business owners all the time. Sadly, navigating the complexities of statutory sick pay (SSP) often leaves you with more questions than answers.

You’re not alone there either. Many experts and charities in the UK are calling for an overhaul of the UK’s sick pay system, and have highlighted the need for more clear guidelines.

I’ve had years of experience at Charlie helping small businesses stay up-to-date with UK law requirements, and that extends to their sick leave. I hope this guide on statutory pay in the UK will help you to make the best of a bad job when an employee falls ill.

What is statutory sick pay (SSP)?

Statutory sick pay (SSP) is the minimum amount that an employee is entitled to if they become too sick to work.

As per UK employment law, employees can get an SSP payout of £109.40 per week, paid by their employer for up to 28 weeks. This rate is pro-rated for part-time employees.

You are required to pay statutory sick pay under UK law. However, not everyone qualifies for it. Some basic eligibility criteria must be met before an employee can get statutory sick pay:

- Your employee must not be a freelancer or a contractor

- Your employee must meet a minimum earnings threshold of at least £123 a week before tax

- The illness must last for four days in a row

How is SSP calculated?

You cannot give your sick employees less than the statutory amount. Luckily, calculating statutory sick pay is a pretty straightforward process. Here’s how you do it step-by-step:

Step 1. Determine eligibility: Check if the employee meets the basic eligibility criteria. Are they an employee? Do they meet the earnings threshold of £123 a week? Have they been ill for four days or more? If the answer is yes, move on to the next step.

Step 2. Calculate weekly earnings: Then you’ll have to sum up the employee’s weekly earnings before tax. That’ll give you a baseline for the SSP amount you pay.

Step 3. Identify qualifying days: These are the days that the employee actually works. If an employee works Monday through Friday, those are the qualifying days. SSP is not paid out for the first three days an employee is sick. These are referred to as “waiting days”.

Step 4: Apply the SSP rate: Finally, apply the SSP rate for the number of qualifying days that the employee has been sick. Multiply the SSP amount by the number of qualifying days the employee has been sick, and that’s the total SSP amount you pay.

Employer’s responsibilities on statutory sick pay

You have a legal and ethical responsibility to your employees when they become too sick to work and need a way to support themselves while they recover. Here are a few things you’ll want to keep in mind.

Maintain accurate records

Keep accurate and up-to-date records of your employee’s sickness and SSP payments. The SSP payments in particular are a legal requirement. You’re obligated to keep these records for at least three years.

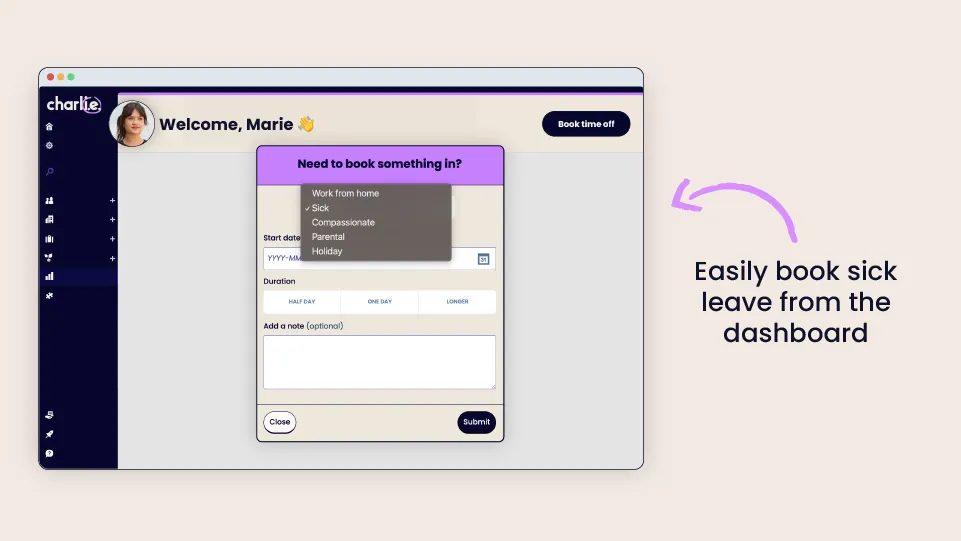

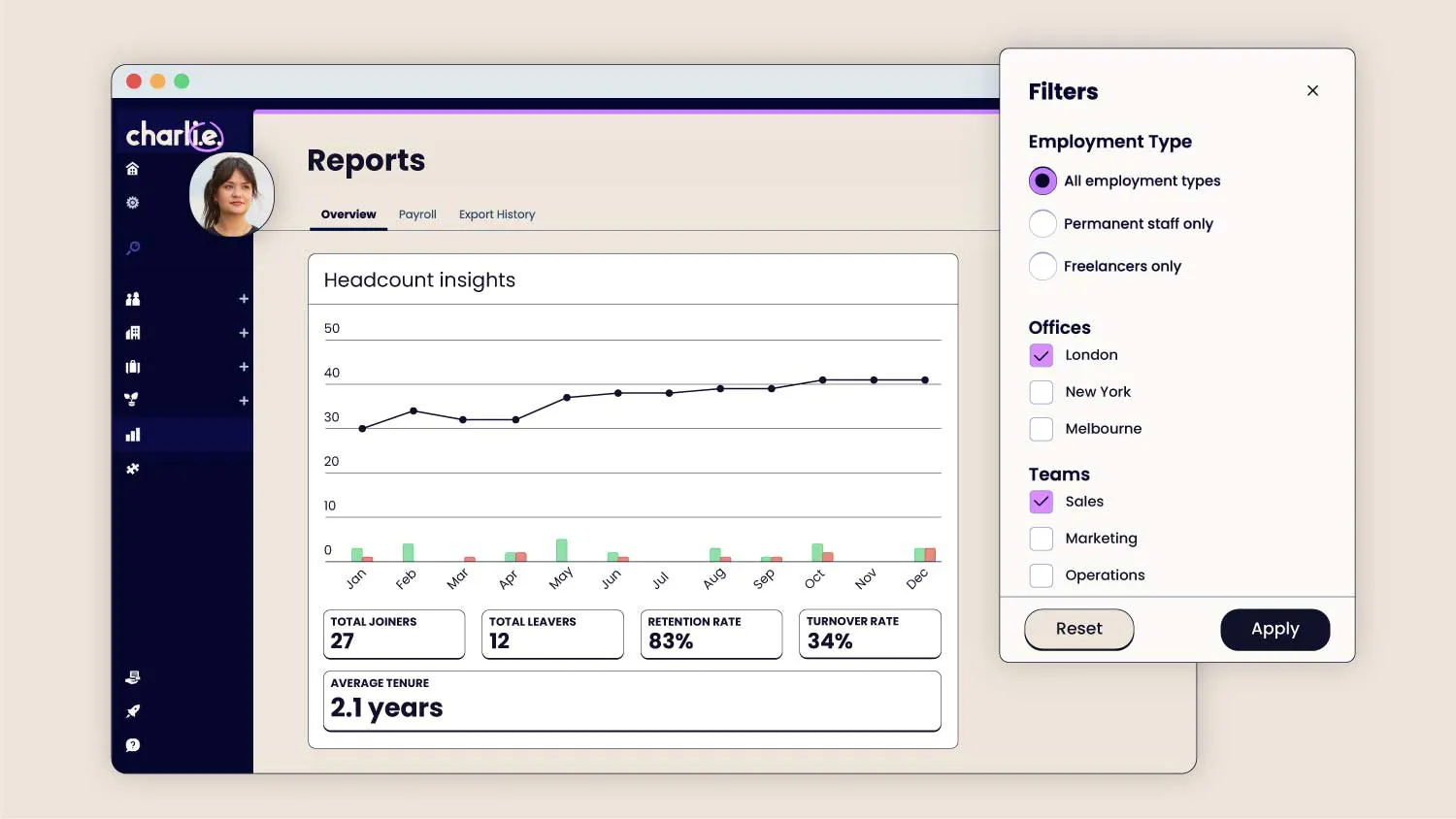

You can use HR software like CharlieHR to keep track of your employees’ sick days. With Charlie, your employees can book a sick day in one click, and their line managers are automatically notified when this happens.

As a People leader at your company, you can view in-depth reports on sick leave anytime you need from your Charlie dashboard.

Obligation to pay SSP

You are obligated to pay SSP for up to three weeks. That is the maximum length of time during which an employee can claim SSP.

Have a transparent sick leave policy

Having a sick leave policy that is fair, transparent and accessible to everyone on your team helps everyone stay on the same page about what the procedure is when someone becomes sick.

At Charlie, we offer 20 days of full pay for sick leave. Going above and beyond the legal minimum requirements helps our employees at a time when they’re vulnerable and need support.

Employee’s responsibilities

It’s not all just on you though. Your employees have certain rights and responsibilities of their own when it comes to managing their statutory sick pay.

1. Inform their employer: One of the first things your employee needs to do when they become too ill to work is to inform you of the situation. The timeframe for doing this should be spelt out in your sick leave policy.

2. The need for a ‘fit note’: Your employee will also need a “fit note” from their general practitioner if they are ill for more than seven days. That provides documentation of their illness you can keep for your employee records. It’s also needed to claim SSP for longer periods.

Understanding your and your employee’s rights and responsibilities when it comes to statutory sick pay makes sure that your small business stays legally compliant, and that your employee maximises their benefits.

How we approach sick leave at Charlie

I like to hold up the Charlie sick leave policy as an example of how small business owners can manage and distribute statutory sick pay.

Going beyond the minimum legal requirements outlined by statutory sick pay means that Charlie employees do their work when they are rested, healthy, energised, motivated, and engaged. That means they are more productive and are more engaged with their work.

Our sick leave policy is made up of three parts:

- 20 days of full pay

- 20 days at 50% pay

- 20 days at 25% pay

Our sick leave policy is designed to be generous. Charlie employees won’t need to rely on SSP unless they’re on sick leave for more than 60 days in 12 months.

That way, employee engagement is better and team members are more loyal. There is better employee retention: employees stick around. After all, they know that if they fall on hard times and need support because they’re too sick to work, Charlie will take care of them.

This is what works for us at Charlie. I encourage you as a small business owner to consider making your own generous sick leave policy that goes above and beyond the minimum.

Take the stress out of statutory sick pay with Charlie

Knowing your responsibilities as an employer to the employees on your team helps you stay legally compliant as a business, create a transparent and fair work environment, and help your employees stay more present and productive in the long run.

Effectively managing your sick leave and giving a generous sick leave policy helps you make a better business. Charlie can help you manage and schedule your SSP payments more easily. Try a free trial today, and start building the way to a healthier, happier company.