What is salary sacrifice and how does it work?

A higher salary can be an effective way to attract and retain talented employees, but for some people, it’s the extras you can offer that makes your overall package more appealing. It may sound counterintuitive, but reducing salaries in exchange for a different type of benefit can be great — a process known as salary sacrifice.

In this guide, we’ll explore what salary sacrifice is, how it works, and what the benefits are. We’ll also share examples of some of the most popular types of schemes, and answer all your burning questions about how to manage salary sacrifice programmes.

What is salary sacrifice?

Salary sacrifice is a voluntary scheme that allows employers to easily offer non-cash employee benefits to employees by making a deduction to their pre-tax gross salary. You might also hear this referred to as salary exchange.

Giving up part of their salary might sound like a bad idea initially, but in reality, it introduces benefits for both parties, like lower National Insurance contributions (NICs). This makes salary sacrifice arrangements a cost-effective way for employees to save towards a pension, pay for transport, or invest in health insurance — and an attractive addition for companies that want to attract and retain talent.

Salary sacrifice is a government-backed scheme that any company can offer, so you’re never too new or small to start considering it.

How does salary sacrifice work?

Schemes like salary sacrifice have attracted a reputation for being difficult to set up and maintain, but that’s not the case.

You’ll need to decide as a company which salary sacrifice schemes you want to offer alongside your other perks and benefits, and then find a matching provider. This process can take some time, but once it’s up and running you’ll be able to onboard new employees into your schemes.

Here’s how salary sacrifice works for the employer:

- Agree to the change. You and your employee both need to come to an agreement on what their new salary will be, and what non-cash benefit they’ll be receiving in exchange. Note that their salary must always meet or exceed the National Minimum Wage (NMW) rate.

- Alter the contract. To meet legal requirements, you need to put this change in writing and alter the employee’s contract. It should clearly outline what the cash (salary) and non-cash benefits are.

- Adjust the employee’s salary. Once you’ve signed the new contract, update the employee’s pre-tax salary within your payroll system.

- Distribute the benefit. With the new deductions in place, your employee can now take advantage of the benefit — like buying a bicycle or leasing a car. Follow the scheme provider’s process for this.

For employees, they simply need to read and understand your policy and agree to any contract changes. Their new salary will be adjusted through your payroll system, and they’ll begin to benefit from their new product or service.

Popular types of salary sacrifice schemes

Companies can decide which salary sacrifice schemes to offer depending on their needs and goals, but some are more common than others. Let’s explore some of the most popular examples of salary sacrifice.

Pension contributions

While there’s a minimum employer contribution (3%) and employee contribution (5%) to workplace pension schemes, employees can choose to reduce their pre-tax salary to make extra contributions to their pension pot.

With a lower pre-tax salary, employees often benefit by paying lower income tax and National Insurance contributions. Employers can make savings on NI too.

Your employees can choose how much of their salary to sacrifice for pension contributions, in line with your internal policy and any scheme restrictions. The only restrictions beyond this are that their salary must not fall below the National Minimum Wage (NMW) rate, and that total pension contributions can’t exceed £60,000 per year.

Some employees may choose to increase their pension contributions to build up a larger pot for their retirement. Others may carefully balance contributions so that their take-home pay barely changes, while reducing tax and NI contributions.

Cycle to work scheme

Cycling to work is a win for the environment and physical health, but not everyone can buy a new bike outright. The government-backed cycle-to-work scheme helps employees get the equipment they need without delay, and make savings in the process.

Cycle to work schemes typically allow employees to pay for bikes and accessories over the long term, so they can spread the cost. This means employees can invest in the best bike, accessories, and safety gear for their needs without worrying about the upfront amount. As with any salary sacrifice scheme, employees also benefit by paying less in tax and NI contributions.

For employers, offering a cycle to work scheme is an ideal way to support your sustainability goals and promote your health and wellness values — it’s a scheme we proudly offer at Charlie. You’ll also benefit from any happiness, productivity, or engagement increases as a result of your employee’s lifestyle change.

Car leasing

If cycling isn’t an option for your employees, you can still support their transport needs by offering car leasing options via salary sacrifice — including eco-friendly electric cars.

Partner with a provider that can offer new or nearly-new lease cars to your employees, in exchange for a pre-tax salary contribution. Employees benefit from a well-equipped car with servicing and maintenance cover, and make savings on tax and NI.

You can choose to run a company car scheme where you lease the car from the provider for work-related use, or one where the contract is between the provider and your employee directly. Depending on the terms, an employee may need to pay benefit in kind (BIK) tax at the end of the tax year.

Healthcare

For companies that want to promote wellbeing at work and support work/life balance, healthcare schemes are a positive addition. At Charlie, our health insurance is available as part of a salary sacrifice scheme.

There are a range of health and wellness schemes providers you can work with — like health insurance, gym memberships, mental health support subscriptions, and therapy programmes. This means you can tailor your schemes to meet your individual employees’ needs best.

Healthcare-focused salary sacrifice arrangements save your employees money over time, while allowing them to access discounted or hard-to-reach support programmes. Offering these options to employees supports wider health and wellbeing goals, supports a positive company culture, and can help with employee retention and recruitment.

Childcare

The government’s Childcare Vouchers scheme closed for new entrants in 2018, but you can still help employees with childcare costs through workplace nursery schemes.

Although the name suggests you need a nursery in your workplace, that isn’t the case. You can open up a scheme where employees can contribute towards nursery fees for your own in-house nursery, a chosen provider, or any childcare provider of the employee’s choice.

With childcare costs so high, offering this as an option to your employees can make a huge difference to their monthly budget. They’ll be able to pay childcare fees from their pre-tax salary, and save on NI contributions and taxes.

Offering a childcare salary sacrifice scheme is a proactive way to help your existing employees and support parents and carers to re-enter the world of work — increasing opportunities for underrepresented groups and increasing diversity within your company.

What are the benefits of salary sacrifice?

We’ve touched on this throughout, but the main benefit of salary sacrifice schemes for both parties is the opportunity to pay lower tax and National Insurance contributions as a result of a lower pre-tax salary. These arrangements have other benefits though, too.

Some of the best employee benefits include:

- Lower tax and National Insurance contributions

- Access to a cost-effective way to increase employee pension contributions

- Easier way to finance large purchases like a car lease or high quality bicycle

- Opportunity to customise their benefits package to match their lifestyle and goals

Benefits for employers include:

- Reduced payroll costs on tax and National Insurance

- Ability to attract and retain employees by offering a wide range of supportive schemes

- Opportunities to directly impact sustainability, wellness, or diversity goals

- Chance to benefit from increased levels of employee happiness, engagement, or satisfaction

Salary sacrifice schemes are a win for both parties financially, but offer benefits in other areas too — like wellbeing, productivity, recruitment, and retention.

Should you introduce salary sacrifice schemes?

Salary sacrifice schemes do take time to set up, maintain, and administer — there’s no escaping it. But the administrative cost is often outweighed by the benefits, especially if you’re able to attract talented individuals and earn their loyalty through supportive health, wellness, transport, and family-focused salary sacrifice schemes.

Consider your company goals, challenges, and capacity, then decide whether introducing or increasing your salary sacrifice schemes is the right choice. Use this guide to help you navigate the process and come up with a plan that works for you.

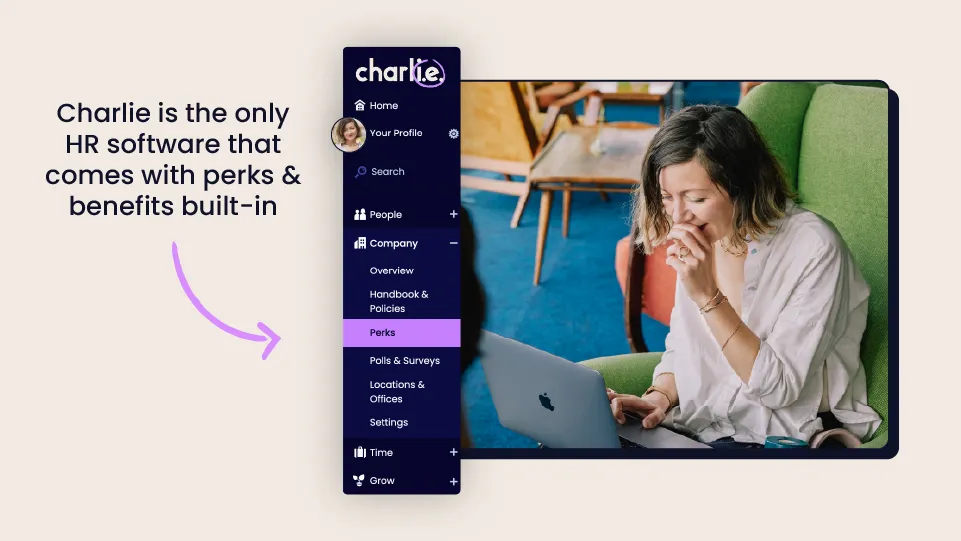

If you’re reflecting on your overall benefits package, consider making the move to Charlie. Our perks system means you can offer industry-leading benefits, without a big impact on your budget. Explore the system yourself with a free trial and discover how Charlie can help you stand out from the competition.

Salary sacrifice FAQs

Is salary sacrifice a good thing?

Salary sacrifice is a great option — especially for employees. They benefit from higher take home pay, and make tax savings. Employees also get the benefit from the service or product they’ve bought too, like a new bicycle or a growing pension pot.

What are the downsides of salary sacrifice?

Any reduction in salary through salary sacrifice can impact entitlement to benefits, schemes, or offers calculated based on pre-tax salary. This can include statutory maternity pay or paternity pay, statutory sick pay, state pension, insurance cover, and mortgage offers. Employees should be mindful of this and weigh up any pros and cons of reducing their salary.

For employers, running salary sacrifice schemes takes time, effort, and money. Consider whether you have enough capacity within your team to manage multiple schemes, or if there’s a provider that can offer more than one option.

Is there a salary sacrifice limit?

There’s no set salary sacrifice limit, but an employer must make sure that any deductions don’t take an employee’s salary below the National Minimum Wage. Another thing to consider is that there’s a limit to tax-free pension contributions per year — currently, this is set at £60,000.

Do I need to offer salary sacrifice to everyone?

While not everyone will take up the offer, you should offer any salary sacrifice schemes to all employees. Your salary sacrifice options should be open to all of your employees freely, although you may need to consider whether you can opt them in based on their salary level.

Can employees opt in or out at any time?

It should be easy for employees to opt into or leave a salary sacrifice scheme. Make it clear to would-be joiners what the process is and if there’s any minimum period or requested notice period. Any time an employee opts into or out of a salary sacrifice scheme you must update their contract.

Do most employers offer salary sacrifice?

Salary sacrifice schemes can be great for both employers and employees, but they’re not as popular as you might imagine. Six years ago just 41% of SMEs offered salary sacrifice pension schemes — we’re hoping this has increased since!

How do I manage my salary sacrifice scheme?

Most payroll software allows you to set up and manage salary sacrifice schemes for pensions, if they’re designed with the UK market in mind. This includes Xero and Pento, two tools that also integrates smoothly with Charlie. Providers for other schemes like cycle to work or healthcare will have a built-in system that allows you to manage your programme effectively.