What is a new employee starter checklist and who is it for?

The job descriptions are written and the recruitment ads are out — you’re ready to start welcoming your new team members! Or are you?

As an HR advisor at Charlie, I advise startups and small businesses on how to comply with UK employment law, and onboarding new starters involves more paperwork than many first assume — including some important documents you need to stay compliant.

Whether you’ve just embarked on a hiring spree or are about to recruit your first paid employee, this blog outlines the paperwork involved in employing someone new so that you avoid making any mistakes with legal repercussions.

We’ll go through the starter checklist (also known as the new employee starter form), and how it differs from a P45 and a P46, and put everything into context so you understand how the new starter forms in the UK apply at your own business.

We’ll also look at how HR software like Charlie automates the entire onboarding process, including the new employee starter form, taking away the hassle and helping you to stay compliant.

And if you’re in search of a template to get you started, then we’d recommend going straight to the gov.uk website – their free free new employee starter form template is the most reliable and up-to-date.

Now, as a first onboarding step, let’s start by getting to grips with the terminology…

What is a P45?

A P45 is the form an employee gets when they leave an employer to go and work somewhere else. It shows how much tax they've paid during the tax year so that their new employer can submit that information to HMRC.

What is a P46?

A P46 was previously used if a new employee didn't have a P45 from their last employer – i.e. someone starting their first job or returning to work after an extended break – to ensure they paid the correct amount of tax. The P46 has now been replaced with the starter checklist.

What's the difference between a P45 and P46?

A P45 is the form everyone gets when they leave a job. A P46 was required if a new employee didn’t have a P45.

What is the difference between a P46 and a starter checklist?

A P46 form was only used for new employees who didn't have a P45. The new starter checklist can be used for all new employees, whether they have a P45 or not.

What is a starter checklist form? (And is it the same as a P46?)

A starter checklist provides employers with the information they need to add a new employee to their payroll with the correct tax code. It used to be known as a P46.

The new starter checklist replaced the P46, but it can be confusing as both names are still widely used.

So:

- A P45 is a document people get from their employer when they leave a job

- A starter checklist (formerly a P46) is a document that must be completed when an employee starts a new job.

To reduce confusion, we’ll only refer to P45 or starter checklist from now on in this blog.

What is a P60?

A P60 outlines the tax and National Insurance contributions that an employee has paid over the previous tax year. P60 statements are issued every year.

When do you have to complete a starter checklist?

Employers must ensure that starter checklists are filled out as soon as possible during the onboarding of a new team member and that all details are then entered into the payroll system correctly. This is vital to ensure the right tax is paid.

What information do you need to complete a starter checklist?

To fill out a starter checklist or new employee starter form, a new team member will need to have the following information to hand:

- Their address, including postcode

- Their student or postgraduate loan plan type(s) (to check their plan type, employees need to sign into their student loans repayment account)

- Their passport number if they’re working in the UK temporarily

- Their National Insurance number

They will also need to know about any income they’ve received that tax year from:

- Another job

- A pension

- Employment and Support Allowance, Jobseeker’s Allowance or Incapacity Benefit

All of this information needs to be accurately recorded to avoid your new starter paying the incorrect amount of tax.

Is it possible to automate starter checklists?

By now you’re probably thinking that there’s a significant chance of making a mistake when onboarding a new employee — and you’d be right. There’s a lot of information involved.

And in the world of small business, there are always other things that need your attention.

The good news is that there are tools out there that simplify the entire onboarding process and remove the chances of making an error. And they’ll take care of the starter checklist for you.

Our all-in-one HR software Charlie is one of those tools.

How does Charlie simplify the onboarding process?

Charlie is more than just an onboarding software, it makes it easy and hassle-free. This is because:

- The system is designed to collect all the data required by the law, so there's no chance you’ll forget anything

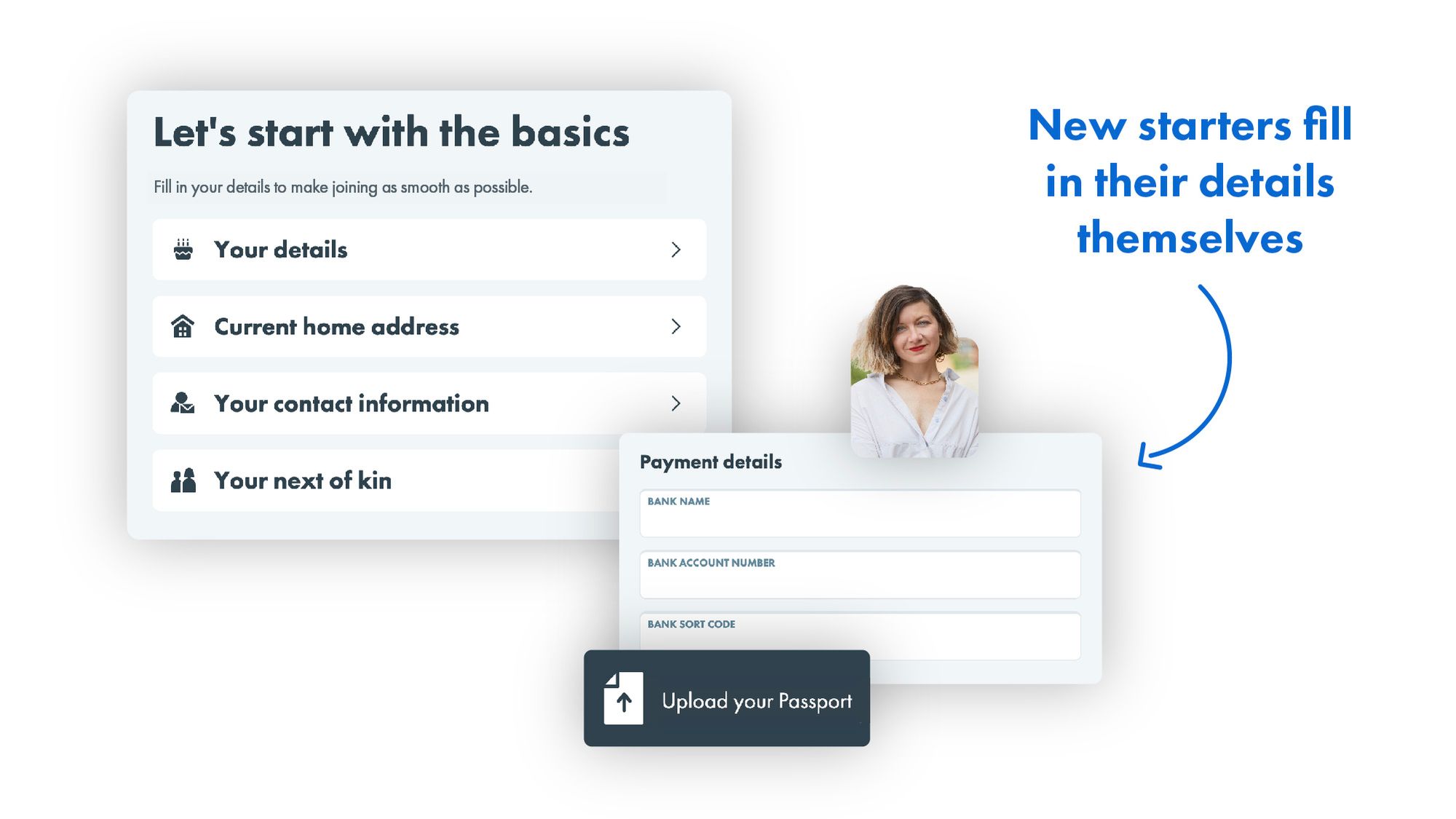

- Charlie works on an employee self-service basis, so it takes away all the faff — all you need to do is enter the new employee’s name and email address. The system then alerts your new hire, who is responsible for uploading their own information.

With software like Charlie, you have the peace of mind of always being on the right side of the law. Plus, you’ll save hours of onboarding admin with every new person you employ, giving you the chance to focus on what matters — like welcoming your new hire to the team.

Onboarding in Charlie works like this:

- As soon as a new starter signs their employment contract, you add them as a new team member in Charlie

- They’ll then receive a welcome email and can log in

- From here, your employee can easily and quickly add their details to Charlie themselves — we call this self-service onboarding:

- National Insurance number

- P45 or starter checklist

- Home address

- Date of birth

- Gender

- Preferred pronouns

- Marital status

- Contact information

- Next of kin information

- Passport number

- Bank account details for payroll

- All of this information is automatically saved in Charlie to be used for payroll and tax purposes. It’s safely stored and only visible to the people you’ve set permissions for, ensuring total confidentiality.

- You can even make sure you got everything on hand when offboarding a team member

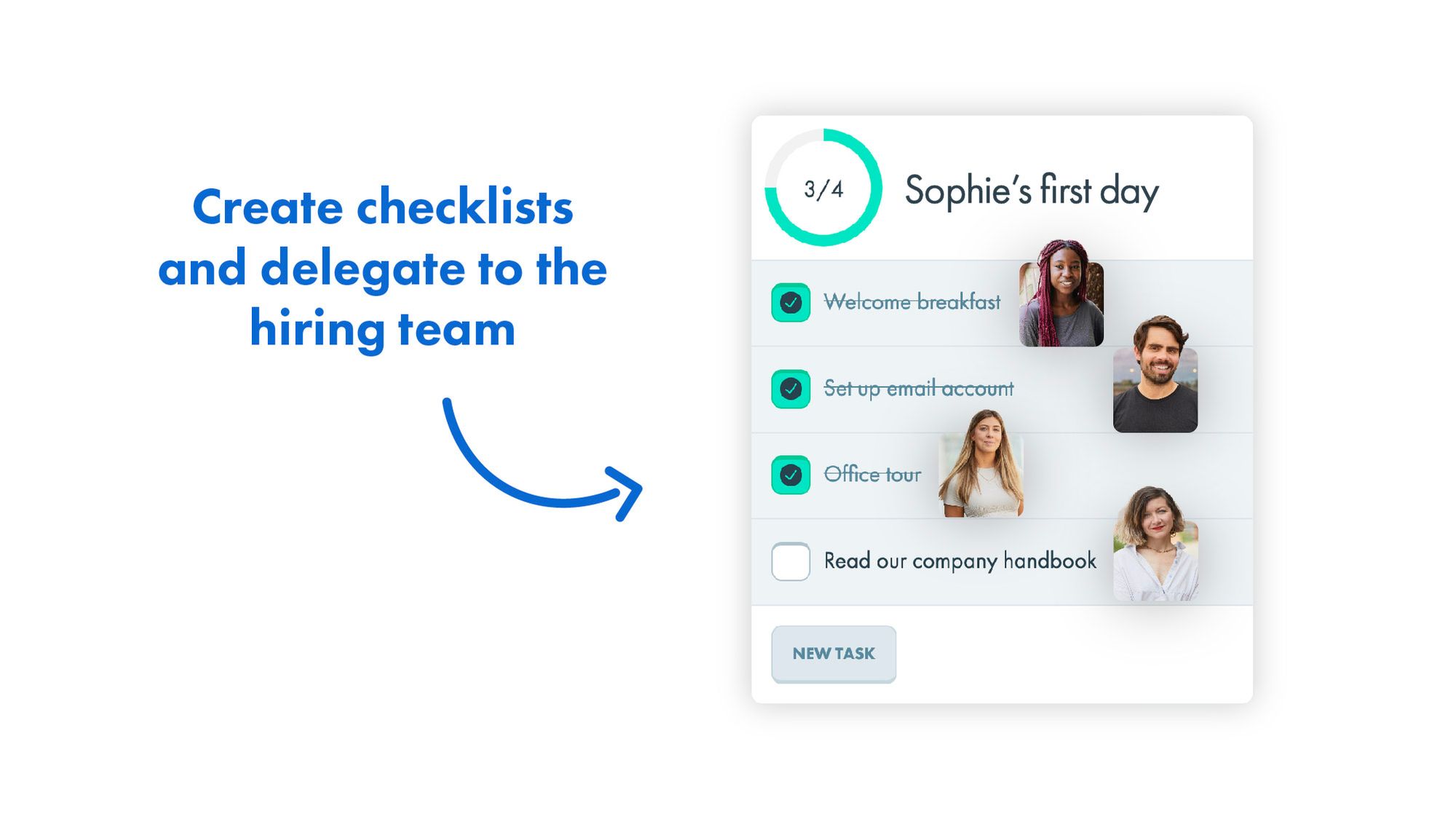

As the employer, you can easily follow every new team member’s progress through Charlie’s automated onboarding checklists. Managers and new employees receive email reminders to ensure all paperwork is completed before the set deadline.

Digitising and automating onboarding best practices with Charlie ensures that every starter checklist is completed on time and with the correct information — saving you a lot of worry and admin.

Onboarding new starters can be easy and hassle-free. Try Charlie free for 7 days to see for yourself.

Interested in finding out more about onboarding? Have a look at our guides: